Smart Money Tools for Families

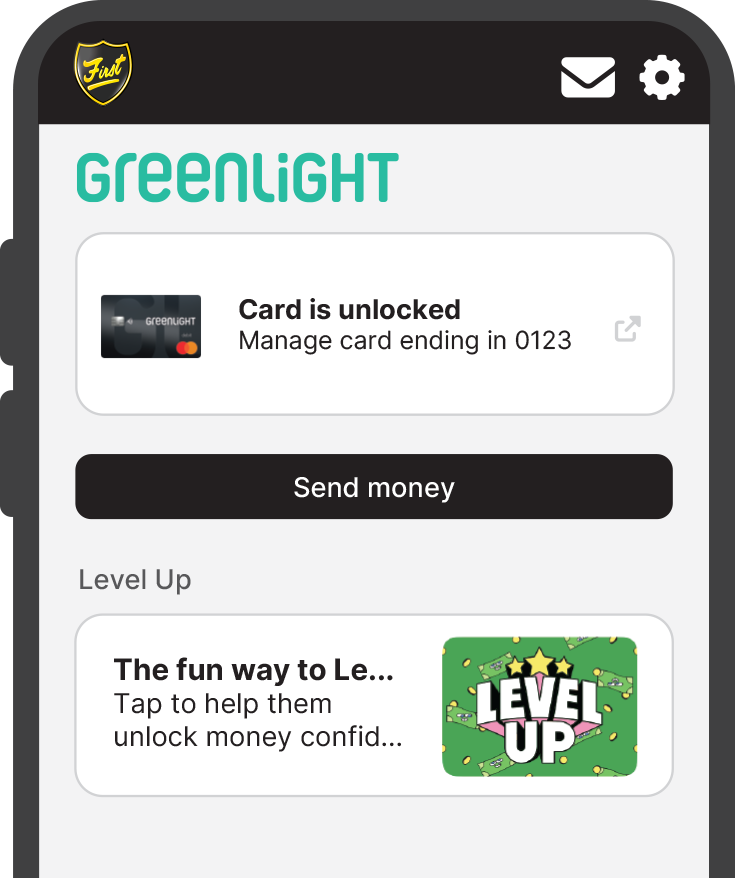

Now in the First Mobile App!

Help your kids learn how to manage money in a safe, guided way.

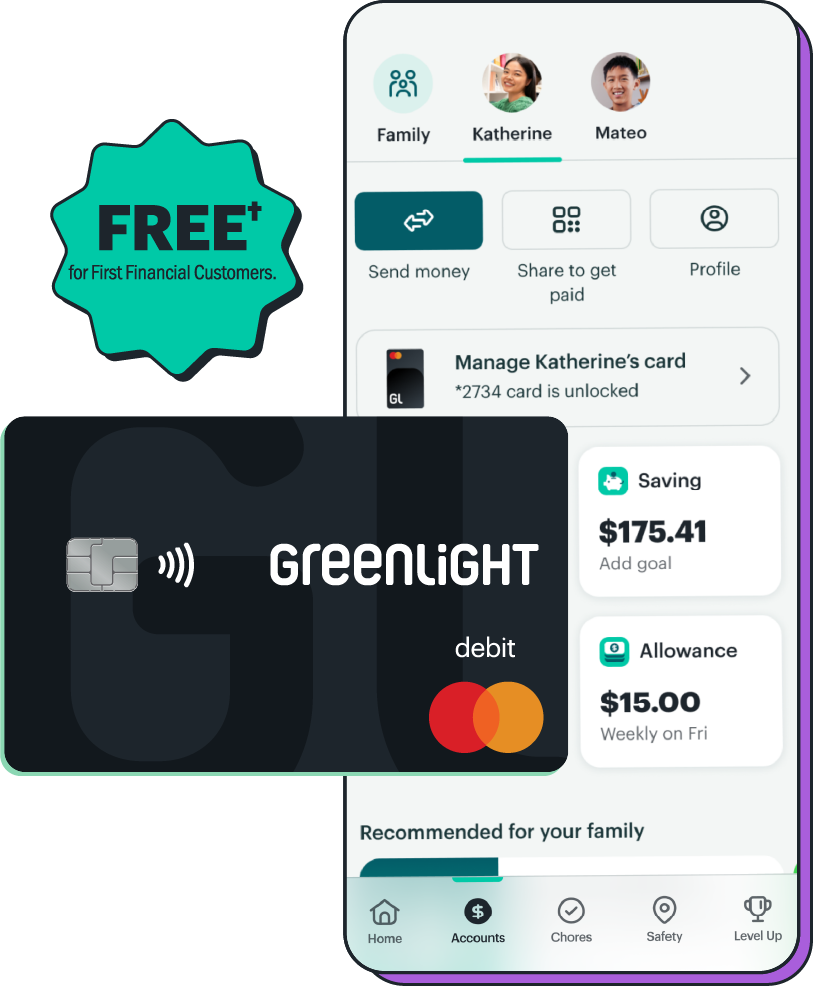

Greenlight is a debit card and app that empowers kids to learn smart money habits while parents stay in control.

What you get with Greenlight:

Money Management

Send money quickly, set flexible controls and get real-time notifications.

Chores & Allowance

Assign chores and automate allowance — with the option to connect payouts to chore progress.

Savings Goals

Set savings goals for what your kids really want — and watch them grow together.

Financial Literacy

Kids play Greenlight Level Up™, the game that makes money concepts easy to understand and fun to learn.

Convenient Access

View Greenlight card balances and transfer money right from the First Mobile app. Plus, click directly into the Greenlight app for advanced features like transaction history and allowances.

Greenlight FAQs

1. What's included in my free* Greenlight subscription?

Your subscription includes debit cards for up to 5 kids, spending notifications, chores, automated allowance, financial literacy game Level Up, and more.

2. How much does Greenlight cost?

As a customer of our partner, your Greenlight subscription is free.*

3. Is there a minimum age?

We support kids and grownups of all ages. No minimum (or maximum) age here.

4. Is Greenlight safe?

The funds underlying Greenlight Debit Card Accounts are FDIC-insured up to $250,000 and come with Mastercard’s Zero Liability Protection. Greenlight blocks unsafe spending categories and lets parents control or turn off cards at any time.

5. Where is the card accepted?

The Greenlight card can be used almost anywhere Mastercard is accepted, online, and in-store. “Almost,” because our cardholders are kids, and we’ve put important guardrails in place.

6. How do chores work on Greenlight?

Create a checklist in the app and assign chores to up to 5 kids. They’ll get reminders — and can check off tasks as they complete each one.

7. How does allowance work on Greenlight?

Set allowance on autopilot or take a more hands-on approach. You can pay a percentage based on chore progress — or only if they’re all done.

8. How does saving work on Greenlight?

Kids save money on Greenlight in several ways.

- Add a savings goal.

- Turn on Round Ups to send spare change from purchases to savings.

- Use Parent-Paid Interest to set and pay an interest rate on your kids’ savings.

- Automate a percentage of allowance to savings.

Download the First Mobile App

Accounts, resources and financial peace-of-mind all in the palm of your hand! Whether you're checking balances at a glance, or moving money in seconds, the First Mobile app makes it seamless.

The Greenlight card is issued by Community Federal Savings Bank, member FDIC, pursuant to license by Mastercard International.

- First Financial Bank customers are eligible for the Greenlight SELECT plan at no cost when they connect their First Financial Bank account as the Greenlight funding source for the entirety of the promotion. Subject to minimum balance requirements and identity verification. Upgrades will result in additional fees. Plans start at $5.99/mo. Upon termination of promotion, members will be responsible for associated monthly fees. See terms for details. Offer subject to change or renewal. Card images shown are illustrative and may vary from the card you receive.