*Registration/activation required.

^ Available online only

1. A point of sale (POS) transaction is one in which you use your First debit card to pay a merchant for a purchase or pay a bill whether by signature or PIN-based. POS transactions do not include ATM transactions.

2. With eChecking, there is a $1.00 fee for each check presented for payment, including a remotely created check. A remotely created check, rather than an electronic debit, may be created by an entity or individual you are paying and to whom you provide your account number and authorize the debit. eChecking is designed for customers who exclusively use electronic means (debit card, ACH, online banking including bill pay) to make payments. This account provides, at no charge, a First debit card, online banking with bill pay and access to electronic statements. To maintain this account, you must have access to a device that: 1) meets the operating system, Internet browsing, and other requirements set forth in the First Online Terms and Disclosures; and 2) connects to a non-public network. You must also enroll, log in, and remain active in online banking and consent to receive electronic statements. If you have not enrolled, logged in, and remained active in online banking and consented to receive electronic statements within 30 days from the date of account opening (the Enrollment Period), or if you later revoke your consent to receive electronic statements, this account will be converted to an Interest Checking account. Interest Checking may include, among other fees, a monthly service charge if certain conditions are not met. If your account is converted to an Interest Checking account pursuant to this paragraph, you will be provided with a Truth in Savings Disclosure for the Interest Checking account.

3. Benefits are available to personal checking account owner(s) and their joint account owners and are subject to the terms and conditions set forth in the Guide to Benefit and/or insurance documents for the applicable Benefits. Benefits are not available to a “signer” on the account who is not an account owner or to businesses, clubs, trusts, organizations and/or churches and their members, or schools and their employees/students. Some of the benefits with IDProtect require registration and activation.

4. One complimentary box per year – any style or design – only valid on personal checking products excluding licensed product checks. Your complimentary checks will be mailed to you within two weeks after you open your account.

5. Special Program Notes: The descriptions herein are summaries only and do not include all terms, conditions and exclusions of the Benefits described. Please refer to the actual Guide to Benefit and/or insurance documents for complete details of coverage and exclusions. Coverage is offered through the company named in the Guide to Benefit or on the certificate of insurance. Insurance products are not insured by the FDIC or any Federal Government Agency; Not a deposit of or guaranteed by the bank or any bank affiliate.

6. Mobile Banking is free from First Financial Bank, but data and text messaging charges from your service provider may apply. Not all accounts or customers are eligible for Mobile Deposit period.

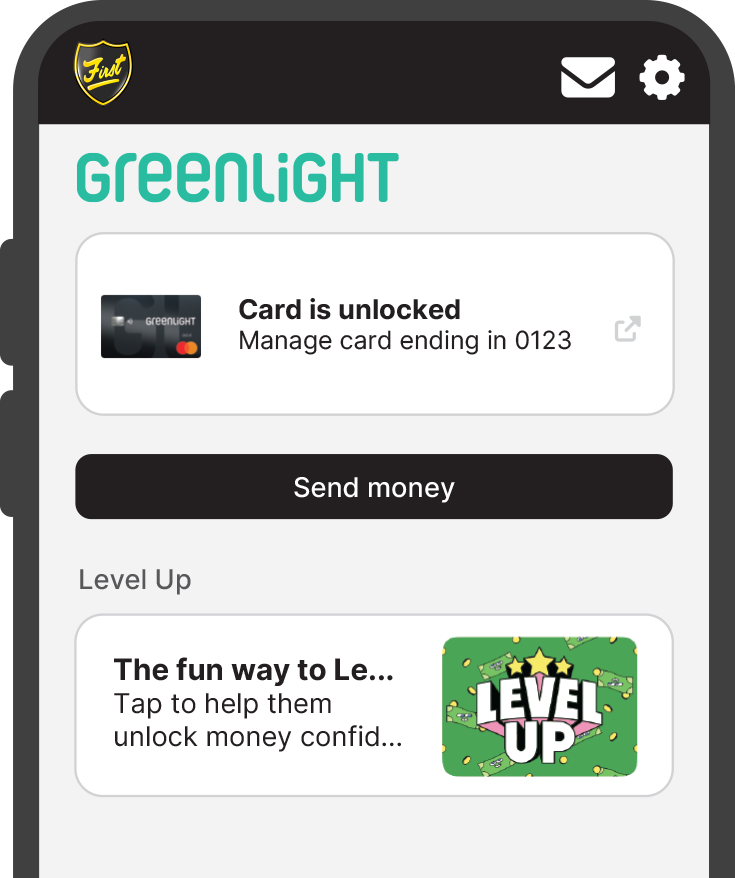

7. First Financial Bank customers are eligible for the Greenlight SELECT plan at no cost when they connect their First Financial Bank account as the Greenlight funding source for the entirety of the promotion. Subject to minimum balance requirements and identity verification. Upgrades will result in additional fees. Plans start at $5.99/mo. Upon termination of promotion, members will be responsible for associated monthly fees. See terms for details. Offer subject to change or renewal. The Greenlight card is issued by Community Federal Savings Bank, member FDIC, pursuant to license by Mastercard International. Card images shown are illustrative and may vary from the card you receive.

Insurance products are not insured by the FDIC or any Federal Government Agency; Not a deposit of or guaranteed by the bank or any bank affiliate.